Double declining method formula

2 x basic depreciation rate x book value. The second is the double-declining depreciation method.

Double Declining Balance Depreciation Method Youtube

To get that first calculate.

. The double declining balance is expressed using the formula. Depreciation 2 Straight-line depreciation percent. In other words the depreciation rate in the double-declining balance depreciation method equals the straight-line rate multiplying by two.

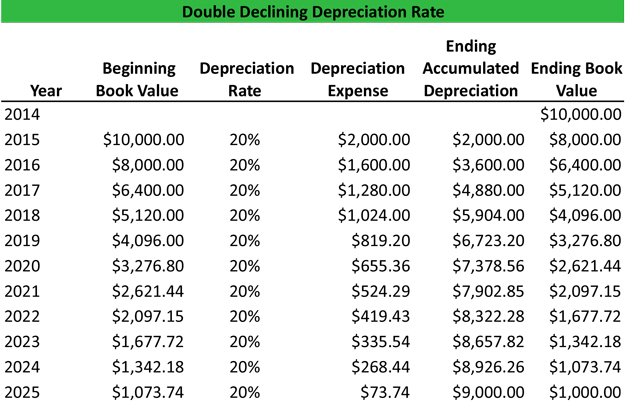

Double declining balance rate 2 x 20 40 The book value of the vehicle at the beginning of 2010 is 50 00000 The depreciation for the first year in 2010 is therefore. This involves accelerated depreciation and uses the Book Value at the beginning of each period multiplied by a fixed Depreciation. Formula for Double Declining Balance Method The formula for depreciation under the double-declining method is as follows.

Heres the formula for calculating the amount to be depreciated each year. To implement the double-declining depreciation formula for an Asset you need to know the assets purchase price and its useful life. When using the double-declining balance method be sure to use the following formula to make your calculations.

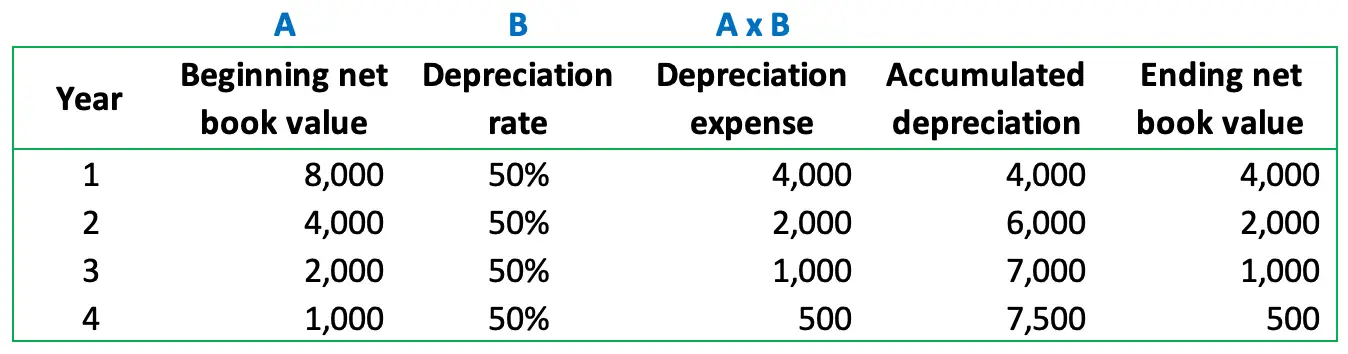

Double declining balance is calculated using this formula. Double Declining Balance 2 Basic Rate of Depreciation Book Value Let us see the meaning of each term separately. To consistently calculate the DDB depreciation balance you need to only follow a few steps.

Double Declining Depreciation Calculator Efinancemanagement The formula for depreciation under. The Double Declining Balance Depreciation Method Formula. While the total expense remains the same over the life.

What is the formula for calculating the double-declining balance. 50 000 x 40. First Divide 100 by the number of.

Double Declining Balance Method formula 2. The double declining depreciation formula is defined quite simply as two times the straight-line depreciation rate multiplied by the book value of the asset. Cost of the asset recovery period.

Your basic depreciation rate is the rate at which an asset depreciates using the straight line method. The double declining balance formula. The DDB depreciation method is a little more complicated than the straight-line method.

What Is The Double Declining Balance Ddb Method Of Depreciation

Simple Tutorial Double Declining Balance Method Youtube

What Is Double Declining Balance Method Of Depreciation Pmp Exam Accelerated Depreciation Youtube

Depreciation Units Of Activity Double Declining Balance Ddb Sum Of The Years Digits Accountingcoach

How To Use The Excel Ddb Function Exceljet

Double Declining Balance Method Of Depreciation Accounting Corner

What Is The Double Declining Balance Method Definition Meaning Example

Double Declining Balance Method Of Depreciation Accounting Corner

Calculate Double Declining Balance Depreciation Accountinginside

Double Declining Balance Method Of Depreciation Accounting Corner

Double Declining Balance Depreciation Calculator Double Entry Bookkeeping

Depreciation Formula Examples With Excel Template

Declining Balance Depreciation Double Entry Bookkeeping

Double Declining Balance Depreciation Daily Business

Double Declining Depreciation Efinancemanagement

Double Declining Balance Depreciation Calculator

Double Declining Balance Method Prepnuggets

Komentar

Posting Komentar